LightCounting: The global optical module market is projected to achieve a compound annual growth rate of 16%

Market research firm LightCounting has updated its forecast for 2024-2028. LightCounting notes that demand for optical connectivity began to decline in the second half of 2022, which led to excess inventory throughout the supply chain. Six months ago, the market outlook for 2023 was very bleak, with major optical module and device suppliers reporting significant revenue declines at the beginning of the year. The market outlook for the second half of this year and even 2024 is not optimistic.

NVIDIA has boosted industry morale in its last two quarterly reports by reporting a sharp increase in sales of AI hardware, including optical interconnect. Google has increased its investment plans in AI clusters, and many other cloud computing companies are following suit. Suddenly, expectations for 2024 are soaring. Components for 4x100G and 8x100G optical modules are already in short supply.

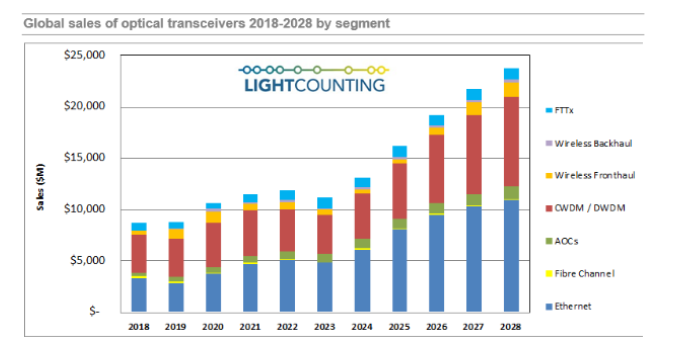

As the chart below shows, it will be too late to prevent a market decline in 2023, but LightCounting expects sales of Ethernet optical modules to grow by nearly 30% in 2024. All other segments are also expected to recover or continue to grow next year, albeit to a lesser extent. After a 6% decline in the global optical module market in 2023, it is expected to grow at a compound annual growth rate of 16% over the next five years.

Amazon, Google, Microsoft and other cloud computing companies are expected to lead the development of new AI applications. This will require a major upgrade to its AI cluster, which uses a lot of optical connectivity. The next two years are mainly 400G and 800G Ethernet optical modules and AOC. The upgrading of data center cluster connectivity is also accelerating, which means that 400ZR/ZR+ shipments will increase in 2024-2025 and later 800ZR/ZR+ shipments.

In the past few years, cloud computing companies have achieved high growth. However, as the growth slows down, they have to re-evaluate their plans by the end of 2022. The capital expenditures of cloud computing companies almost doubled between 2019 and 2022, but current investments are more conservative. It is expected that by 2023, the capital expenditures of the top 15 ICPs will only increase by 1%, basically flat after several years of double-digit growth.

However, investment in artificial intelligence infrastructure will remain a key focus in 2023, accounting for a larger share of total capital expenditure. Unless there is an economic downturn, LightCounting predicts that investments by cloud computing companies will resume stable growth from 2024 onwards.

Telecom service providers plan to reduce capital expenditures by 4% in 2023. From 2024 to 2028, CSP's capital expenditures are unlikely to surge as they strive to find new sources of revenue. The deployment of 5G has not changed this situation, at least not yet.

Moving businesses and consumers to the cloud is a new priority for telecom operators. While large enterprises can establish private clouds, consumers and small to medium-sized enterprises rely on telecom networks. This presents potential opportunities for telecom service providers: offering low-latency cloud broadband connections to a wider range of customers and generating additional revenue. Supporting these services requires continuous investment in access networks and metropolitan area networks.

TEL:13995551051; Email: sales@cloudfiber.cn

TEL:13995551051; Email: sales@cloudfiber.cn